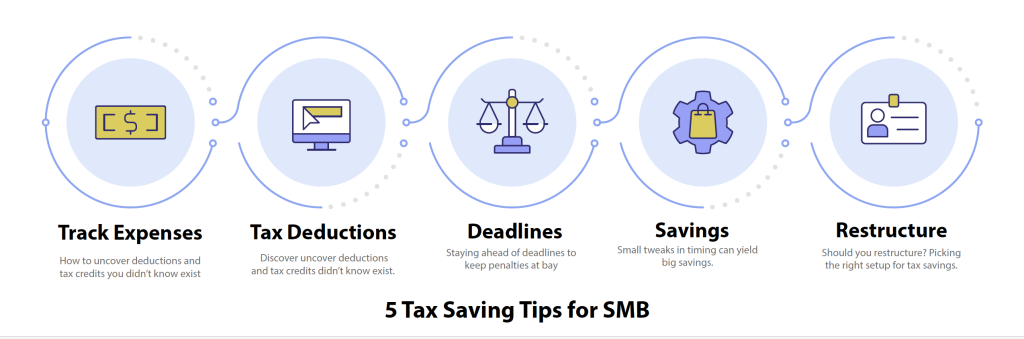

What You’ll Learn From This Blog for SMB (Small to Medium Businesses).

- How to track expenses and maximize every cent you spend

- Ways to uncover hidden deductions and credits

- Tips for staying ahead of filing deadlines to dodge penalties

- Insights on picking the most tax-efficient business structure

- Strategies for timing purchases to lower this year’s tax burden tax saving tips 2026- crescendo accounting.

1. Why tracking every expense is your first line of defense. Accurate records unlock deductions and reduce audit risk.

-

- Use cloud-based bookkeeping tools to scan receipts on the go

-

- Categorize expenses (office supplies, travel, utilities, home office)

-

- Store digital copies and note payment purpose immediatelyImagine a florist who saved $5,000 simply by scanning every home office receipt all year.

Could you be missing out on thousands?

2. How to uncover deductions and tax credits you didn’t know exist. Many credits fly under the radar—don’t let money slip through your fingers.

-

- Vehicle expenses: mileage logs vs. actual costs

-

- Software subscriptions, marketing costs, employee training

-

- Retirement plan contributions and GST/HST rebates.

-

- Have you checked if your social media ad spend or staff up-skilling qualifies?

A quick chat with a pro can reveal industry-specific write-offs.

3. Staying ahead of deadlines to keep penalties at bay, Missing key dates, invites fees —and nobody likes surprises from the CRA!

-

- Mark quarterly instalment dates, GST/HST returns, year-end filings

-

- Set automated reminders or delegate to your accountant

-

- Review your calendar monthly to spot any upcoming due datesEarly birds avoid penalties and stress.

How would it feel to never scramble on Deadlines again?

4. Should you restructure? Picking the right setup for tax savings. Your business structure drives your tax rate and liability.

-

- Sole proprietorship vs. partnership vs. corporation: pros and cons

-

- Income splitting, dividend strategies, personal liability insights

-

- Annual review to reassess structure as profits grow.

A strategic shift to incorporation once saved one startup owner over 15% in combined taxes—what could it do for you?

5. Timing purchases and income strategically. Small tweaks in timing can yield big savings.

-

- Accelerate equipment purchases before year-end to claim depreciation sooner

-

- Defer invoicing or recognize revenue after December 31 to drop into a lower bracket

-

- Balance cap-ex and opex to maximize immediate write-offs

Ever wondered when to buy that new computer? A few weeks can mean hundreds or even thousands in tax relief.

Smart tax planning is more than checking boxes—it’s a growth strategy. By tracking expenses meticulously, unearthing every deduction, meeting deadlines, choosing the ideal structure, and timing your moves, you’ll keep more revenue working for you.

Crescendo Small and Medium Business Accounting is here to guide you every step of the way.

Schedule a Consultation today and transform your tax season into a profit-protecting advantage.

Schedule a Consultation

Could you be missing out on thousands?